A dividend reinvestment plan DRIP is _____. On October 14 2021 the Company approved a dividend reinvestment plan DRIP allowing investors to receive Queens Road Capital shares in lieu of cash as a dividend.

Watford Llc Solicits Shareholder Cooperation On Limited Dividend Payment In Lieu Of Sec Restrictions News Leves

Substitute Payment In Lieu Of Dividend R Robinhood

Crh Com

CF Lieu 23042021 at 1019 am Depends are you do stocks trading every single day.

Dividend in lieu. 19 2021 PRNewswire -- The Dell Technologies NYSE. Rew 23042021 at 235 pm. As they do not receive a dividend they will not get franking credits or LIC capital gains tax deductions and will usually not be subject to income tax.

It puts a fee on carbon pollution creating a level playing field for clean energy. Australian resident participants in the DSSP do not receive a dividend but in lieu of that are issued shares. If I have a margin account you are permitted to borrow a dividend-paying stock in the normal course of business and as a result in such situations instead of a dividend payment I may receive a cash-in-lieu payment.

A dividend aristocrat is a company that not only pays a dividend consistently but continuously increases the. Additionally a quarterly cash dividend of 25 cents was declared payable to shareholders of record at the close of business on December 17 2021. DELL board of directors has approved distribution of a special stock dividend to Dell Technologies stockholders of all its shares of Class A and Class B common stock of VMware Inc.

Dell Technologies Announces Record and Distribution Date for VMware Spin-Off Special Dividend October 19 2021 at 800 AM EDT ROUND ROCK Texas Oct. If I receive a cash-in-lieu payment I authorize you to treat. Cash will be issued in lieu of fractional shares.

The DRIP as approved by the TSX Venture Exchange allows for the issuance over coming years of up to 10 of the current issued and outstanding shares of the Company which would represent a total of 27725265 shares. A stock dividend a method used by companies to distribute wealth to shareholders is a dividend payment made in the form of shares rather than cash. The Company will generally issue C Shares to its ordinary shareholders twice a year in lieu of a cash dividend.

However unlike dividends paid with stock in lieu of cash. With a dividend yield of 5. On the morning of the trading day following confirmation of the our receipt of a dividend payment on a stock we will use the dividend payment or cash-in-lieu of dividend payment if you have a margin account and your shares are on loan at the time of the dividend.

2307 will help reduce Americas carbon pollution to net zero by 2050. Instead holders of Merck common shares will receive cash in lieu of any fractional shares of Organon common stock that they would otherwise be entitled to. Dividends may be paid in lieu of.

Organon will not issue fractional shares of its common stock in the distribution. The distribution will take place in the form of a pro rata common stock dividend to each Dell. Redeem all C shares for cash.

Merck expects the special dividend of Organon stock will be distributed on June 2 2021. For UK income and capital gains tax purposes the price of HSBC shares issued in lieu of the 1998 second interim is GBP76183 for the former 75p shares and GBP76067 for the former HKD10 shares prices rebased and rounded. Accumulating shares is a classification of common stock that is given to shareholders of a company in.

The ex-dividend date is the date after the dividend has been paid and processed and any new buyers would be eligible for future dividends For certain preferred stock the security must be held for 91 days out of the 181-day period beginning 90 days before the ex-dividend date. Stock dividends are primarily issued in lieu of cash dividends when the company is low on liquid cash on hand. If for example I buy dividend stocks for calsberg and BAT.

The Energy Innovation and Carbon Dividend Act HR. It is not meant to be relied on or used in lieu of advice from a professional. Constructive Dividend slide 2 of 2slide 2 of 2 Usually arises with closely held corporations Payment may be in lieu of actual dividend and is presumed to take form for tax avoidance purposes Payment is recharacterized as a dividend for all tax purposes Usually arises with closely held corporations.

The reference price for shares delivered in lieu of cash is US. Do I have to pay income tax. 50 of the dividend paid out of retained earnings subject to a 35 Swiss withholding tax and the balance paid out of capital contribution reserves not subject to Swiss withholding tax.

The Dividend will be distributed on a pro rata basis. MINNETONKA Minn September 13 2021--Communications Systems Inc. I am a student by the way.

No fractional shares or cash in lieu thereof or any other form of payment will be payable under the Dividend. Since the dividend was declared in United States dollars. Shareholders can opt for one of the following.

If a shareholder has opted into a companys dividend reinvestment plan then the dividends or distributions will be reinvested in lieu of a cash payment. Dell Technologies shareholders will receive cash in lieu of any fraction of a share of. Usually dividend income is the distribution of a companys taxable income to its investors.

The content provided on our site is for information only. An optional plan pr ovided by brokerage firms allowing shareholders to automatically reinvest dividend payments in additional shares of the firm. 882 resulting in a conversion ratio of one newly issued share for every 882 dividend rights held.

A stock dividend sometimes called a scrip dividend. JCS CSI or the Company today announced that its board. Redeem the shares for cash and reinvest the proceeds in additional Ordinary Shares.

Dividend Reinvestment

Solved The Rupley Company Declared And Distributed A 5 Chegg Com

Add Stock Dividend Manually For Money Received In Lieu Of Shares On Account Of Merger De Merger Youtube

Dividend Reinvestment Classic Account Management

Dtcc Com

Links Sgx Com

Ppt Dividend Policy Does It Matter Powerpoint Presentation Free Download Id 271946

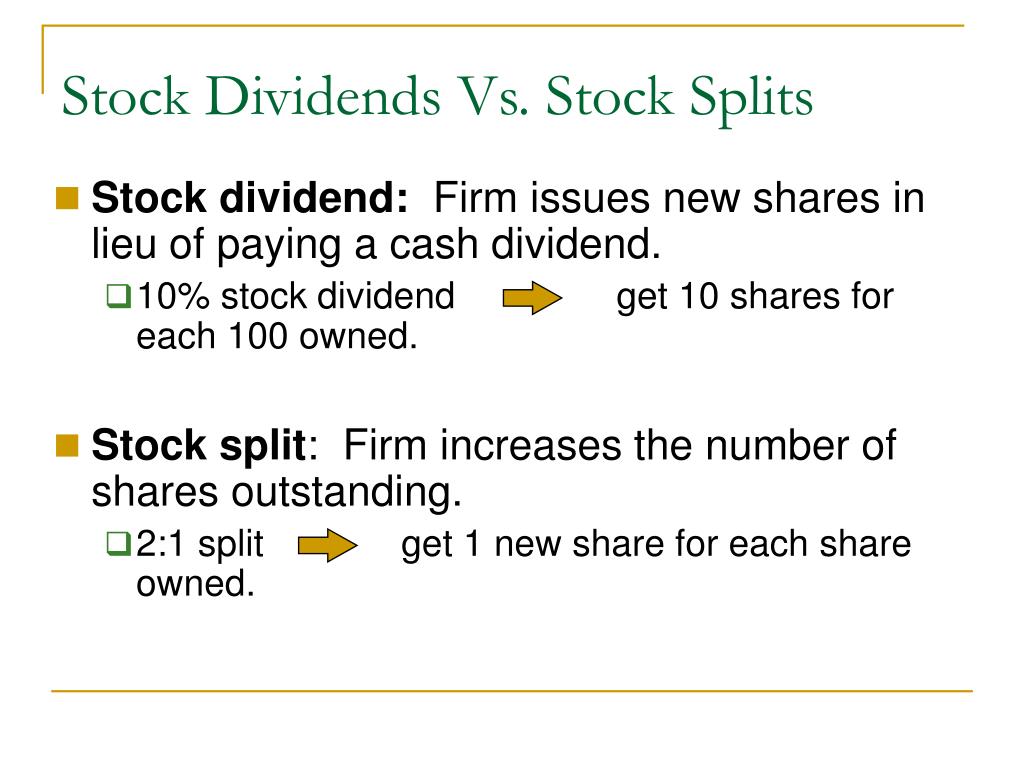

Stock Dividend Definition Example Journal Entries