Ranked by discretionary assets managed in hedge funds worldwide in millions as of June 30 2020 unless otherwise noted. Were no longer in the era where many trading processes were done via paper and phone calls.

How To Invest In Hedge Funds Investing 101 Us News

:max_bytes(150000):strip_icc()/HedgeFunds3_2-0b396b0296d24f51a1b9a43423b68735.png)

Hedge Funds Higher Returns Or Just High Fees

Infographic What Is A Hedge Fund

A hedge fund is basically an investment pool contributed by a limited number of partners investors and operated by a professional manager with specific goals in mind -.

How to work for a hedge fund. List of Most Common Hedge Fund Strategies 1 LongShort Equity Strategy 2 Market Neutral Strategy. As a group thats saying something given that hedge funds got hammered in the first half of 2020 losing a record 79 on average according to an analysis by Hedge Fund Research. Miraculously this appears to be happening to Steve Cohen the tungsten-type.

One of the crucial tools for running a successful modern-day hedge fund is software. Our overall hedge fund sentiment score for MAT is 567. The best hedge fund managers know how important market sentiment is for trading and Tom is their.

Yes there are some who are extremely good at what they do and are able to consistency generate profits year after year but on average most hedge fund analysts get stuck making 200-400K per year. Citadels Surveyor Capital hedge fund unit hired Sachin Kewalramani the former Asia head at Balyasny earlier this year. Right now not.

Bottom line is that people start hedge funds to get very rich and they are going to keep as much as. Hedge Fund Work is the process followed by a hedge fund in order to protect themselves against the movements of stocks or securities in the market and to make a profit on a very small working capital without risking the entire budget. The hedge fund career path is one place where our usual analogy a fraternity house does not quite hold up.

A hedge fund is a pooled investment structure set up by a money manager or registered investment advisor and designed to make a return. We encourage students to learn from the following hedge fund presentations made by the worlds best investors. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher.

The truth about working at a hedge fund. Among hedge fund hires in the US white employees were the dominant race in all but one category quantitative analysts where Asian personnel accounted for 55 of hires between July 1. For some reason people think that if you work at a hedge fund then automatically you make a ton of money.

Rank Manager Assets. The school is suing Woodstock in hopes of recovering the lost funds claiming the hedge fund failed to abide by a side letter directing it to invest in safer more liquid vehicles. Money stays in your brokerage account.

Use hedge fund strategies in a regular brokerage account. How Investor Preferences for Hedge Fund Strategies Have Evolved During the Pandemic Pershings Prime Services regularly collects hedge fund capital introductions insights from. As the name would suggest open-end funds do not have to close which allows investors to contribute to or pull their money out of the fund at any point in time.

Just a flat monthly fee. These investors are the best and brightest of our time and have generated returns far above peers. Hedge fund strategies are a set of principles or instructions followed by a hedge fund in order to protect themselves against the movements of stocks or securities in the market and to make a profit on a very small working capital without risking the entire budget.

Financial regulators generally restrict hedge fund marketing to institutional investors high net worth. Uniting South Floridas Financial Professionals Become a Member Palm Beach Hedge Fund Association We are a South Florida based trade organization consisting of active hedge fund professionals venture capitalists ultra-high net worth investors family offices investment bankers academics and a wide variety of financial experts. A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading portfolio-construction and risk management techniques in an attempt to improve performance such as short selling leverage and derivatives.

The day-to-day work and responsibilities change as you advance but not quite as much as they do in other fields. Hedge funds may be aggressively managed. The two biggest differences between a hedge fund and a PE fund are fund structure and the types of companies that they invest in.

This pooled structure is often organized as either a limited partnership or a limited liability company. We encourage every student aspiring to break into the industry to carefully study their work. The new era of hedge fund creation and operational management Other hedge fund features.

I work at a top macro fund and million dollar salaries are very very rare for analysts even during years when the fund takes in hundreds of millions of dollars. Side pockets and multiple share classes Side pockets are an element of a fund not a fund structure and they can be an effective tool for the hedge fund manager and a source of potential returns for the funds investors. Tom Thornton is the real deal he had a successful hedge fund career and now advises many of the worlds most famous hedge fund managers.

2019 but now work for a different division in the firm. Compared with investment banking or private equity theres less structure and hierarchy to hedge fund careers. Hedge funds are alternative investments using pooled funds that employ numerous different strategies to earn active return or alpha for their investors.

Given the admirable tenure of George Soros who at the very least is still Tweeting aged 91 although his fund is now managed by a 50-year-old woman from UBS working in hedge funds appears to be something that can be done into your senescenceYou simply mellow with age and pursue other interests on the side. Hedge funds are open-end funds whereas PE funds are closed-end. Our goals include providing a unique deal flow network among.

Change from 2019 1. Lucrative salary high perks and best quantitative brains at workhere are the common entry level positions for those aspiring for a career in the hedge fund industry.

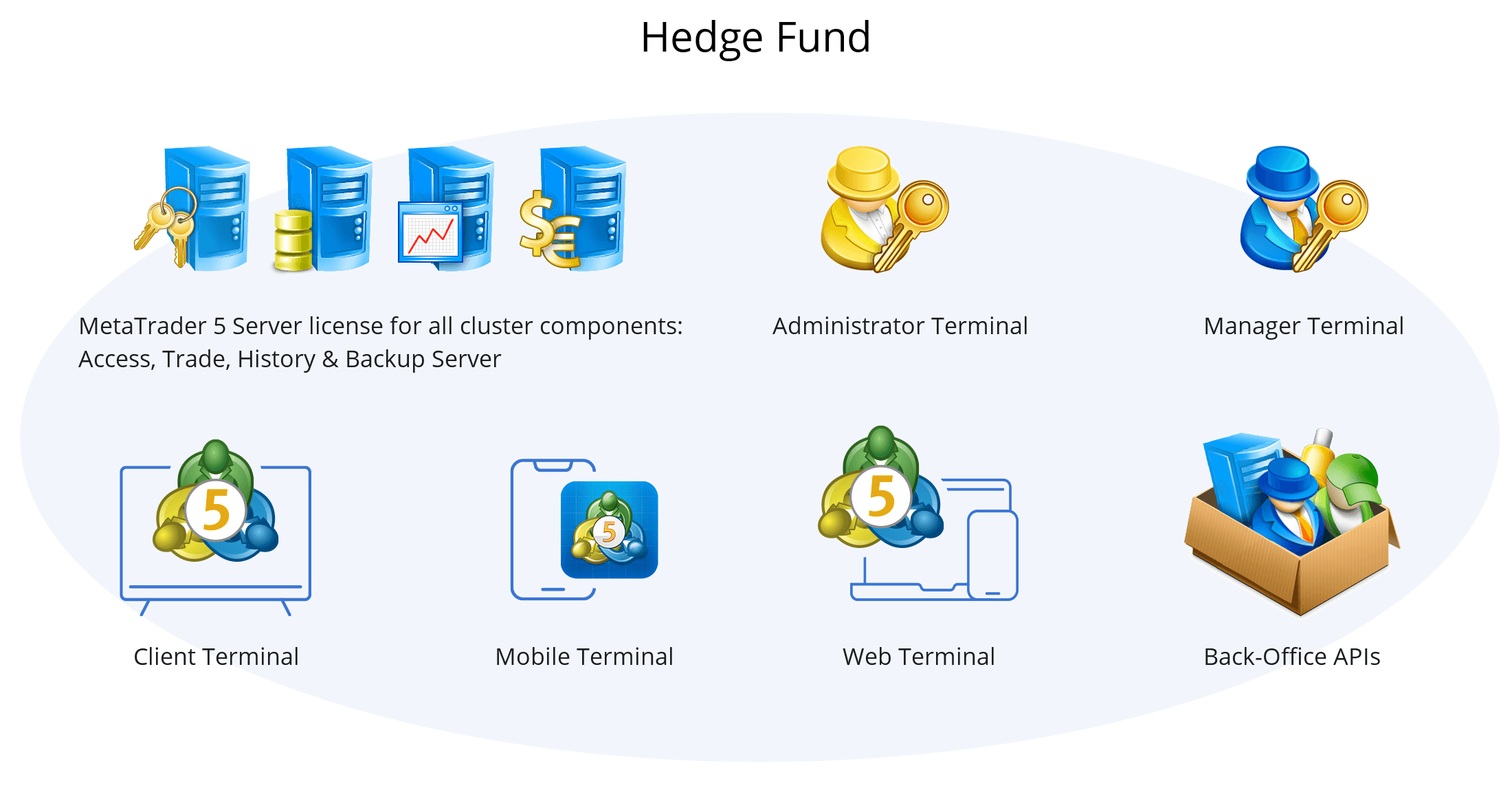

Buy Metatrader 5 Platform

How Does Carried Interest Work Napkin Finance

Hedge Fund Jobs Career Path Salaries Top Tips To Get Hired

How To Become A Fund Manager Career Path Schweser Com

What Are Hedge Funds And How Do They Work Ig Sg

What Is A Hedge Fund Definition Structure Examples Video Lesson Transcript Study Com

Hedge Fund Career Path Job Titles Salaries Promotions

Simple Ways To Work At A Hedge Fund With Pictures Wikihow